Federal Historic Tax Credit impact in Colorado

Federal Historic Tax Credit

Congress established the Federal Historic Preservation Tax Incentive Program in 1976. Current tax incentives were established by the Tax Reform Act of 1986.

- 20% tax credit for the certified rehabilitation of certified historic structures (available to properties listed in the National Register of Historic Places rehabbed for commercial, industrial, agricultural, or rental residential use following the Secretary of the Interior’s Standards for Rehabilitation).

National Impacts

- The Historic Tax Credit created over 109,000 jobs in 2016. (Rutgers University, Center for Urban Policy Research)

- Since 2002, nearly 55% of all Historic Tax Credit projects were in low-to-moderate-income neighborhoods. (National Park Service HTC Quarterly Reports)

- The program generated $29.8 billion in federal tax receipts compared to $25.2 billion in credits allocated. (Rutgers University, Center for Urban Policy Research)

Colorado Impacts

- Between 1981 and 2015, 380 projects in Colorado took advantage of Federal Historic Tax Credits, with qualified rehabilitation expenditures of $640.3 million. Adjusted for inflation, these projects generated a total economic impact of $2.1 billion including direct and indirect. (Preservation for a Changing Colorado)

- Between 2002 and 2015, 72 projects with $278 million in development costs qualified for $46 million in credits. The projects provided 3,719 jobs, generated income of $280 million, and provided $57.8 million in federal, state and local taxes. (National Park Service HTC Quarterly Reports)

- Colorado currently has 23 active projects.

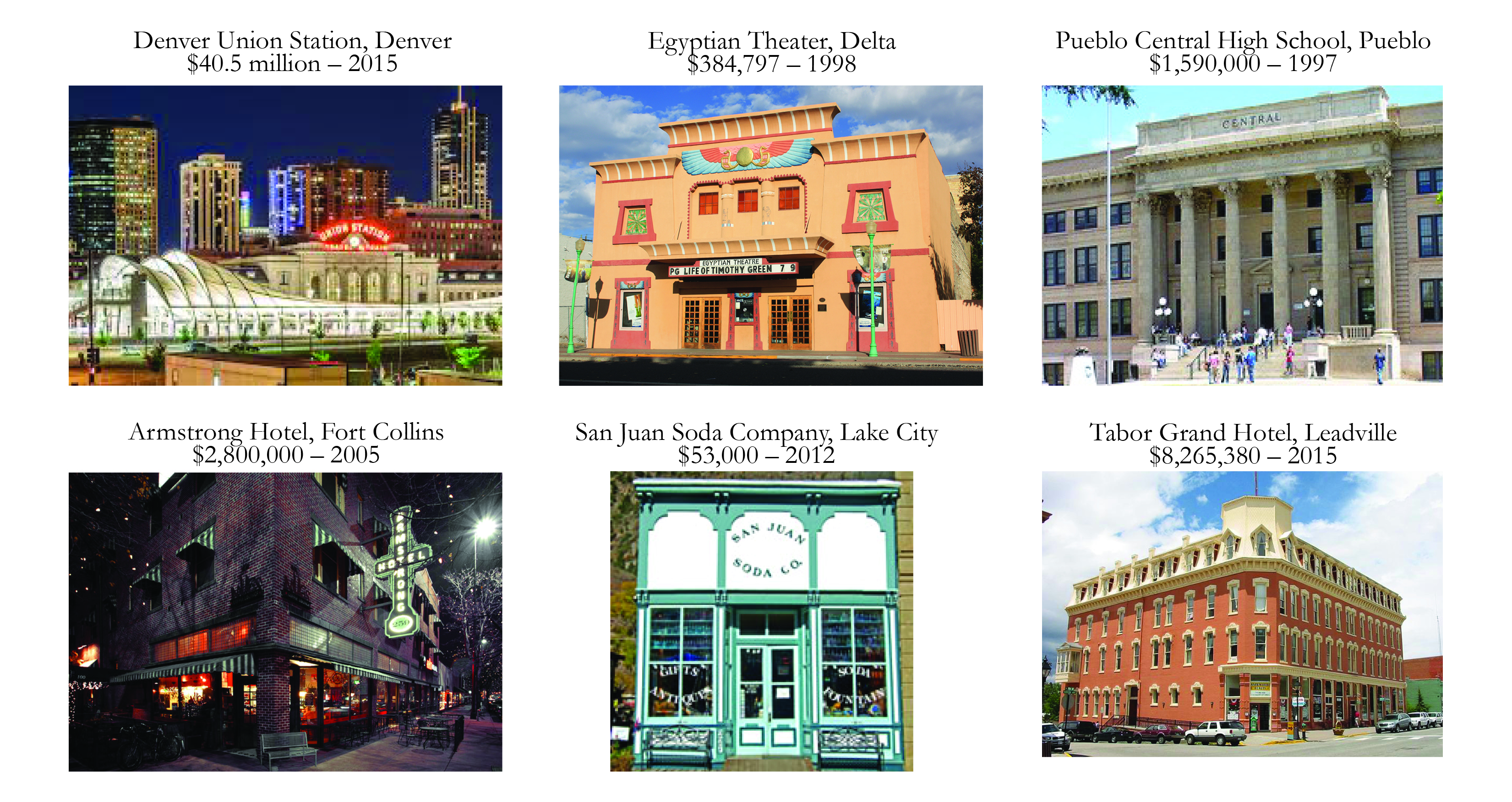

Sample Projects

The Federal Historic Tax Credit has helped make possible many preservation projects around Colorado.

Additional Ongoing Tax Credit Projects

Odd Fellows Building, Littleton - $600,000 credit

Palomo-Springmeyer Building, Breckenridge - $164,000 credit

Sheedy Mansion, Denver - $1,793,560 credit

Shields House, Colorado Springs - $56,969 credit

Yampa Valley Electric Company, Steamboat Springs - $2,968,000

For more information on the Federal Historic Tax Credit in Colorado, contact the Office of Archaeology and Historic Preservation at 303-866-3392 or

Joseph Saldibar

Architectural Services Manager

History Colorado

1200 Broadway

Denver, CO 80203

303-866-3741